Finance

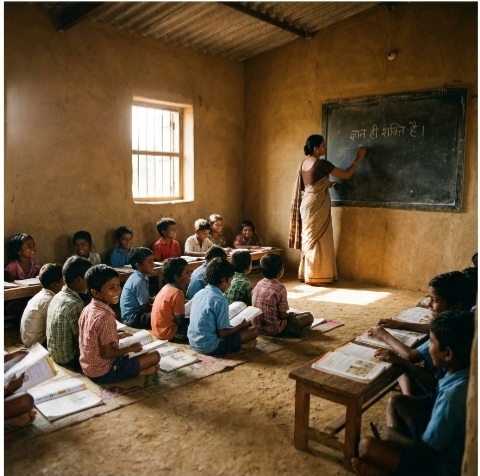

सखी सहेली (स्वयं सहायता समूह )

सखी सहेली संचालन मार्गदशिका को तैयार करने का उद्देश्य समूह का गठन, प्रकार एवं परिचालन हेतु उचित मार्गदर्शन प्रदान करने हेतु की गयी है। यह मार्गदर्शिका गरीब परिवारों को वित्तीय समावेश के महत्व एवं प्रारंभिक अनुभवों एवं सीखो से अवगत कराने का भी प्रयास किया गया है। " स्वयं सहायता समूह किसी एक ही टोले मोहल्ले मे सामान्य सोच रखने वाले व्यक्तियों द्वारा बनाया गया अनापचारिक संगठन है "

समूह का गठन कैसे करें?

1. एक समूह मे 15 से 25 सदस्य हो सकते है।

2. एक परिवार मे केबल एक सदस्य बन सकता है।

3. प्रत्येक व्यक्ति का पंजीकरण शुल्क 235 रूपये है।

4. समूह सभी सदस्यों का बीमा अनिवार्य होगा।

स्वयं सहायता समूह मे नेता एवं जिम्मेदारी..

1. अध्यक्ष

2. सचिव

3. कोषाध्यक्ष

Members can get advances under the daily loan repayment scheme. This scheme is to encourage the members to start income generation ventures and repay the loan on daily basis. The loan period can be a minimum of 90 days and maximum period is 180 days. The loan amount is maximum of the total investment in the company.

For Daily Loans, the loan rate of interest will be a standard rate of interest. There will be 2% additional charges will be applicable for SHG loans in addition to the standard loan processing charges.

Terms & Conditions:

- The loan period will be for three or six months.

- The loan amount will be maximum of Rs. 100,000/-

- A person having daily income will be admissible for Social Gramin Projects.

- The borrower must have account id with Social Gramin Projects.

- The loan will be paid back by daily installments

|

Loan Amount (3 Month) |

Daily Installment |

Loan Amount (6 Month) |

Daily Installment |

|

10,000 |

115 |

10,000 |

60 |

|

20,000 |

230 |

20,000 |

120 |

|

30,000 |

345 |

30,000 |

180 |

|

50,000 |

580 |

50,000 |

300 |

|

1,00,000 |

1160 |

1,00,000 |

600 |

LOAN AGAINST COLLATERAL :

Member can avail loan against the collaterals with the company. Based on the need of a customer, the loan will be processed with a short span of time and disbursed. The loan rate of interest will be as per the Company guidelines. Following types of collateral can be used to avail the loan.

- Immovable collateral such as Land, building

- Investment such as Deposits , Securities in the company

- Investment such as deposits in other financial institutions

- Savings certificates such as NSC, Postal Savings certificates and so on

- Life insurance policies

Gold / Silver jewelry

Recurring Deposit...

A recurring deposit (RD) is a type of savings account offered by banks and financial institutions. Here's how it works:

*Key Features:*

1. *Regular deposits*: You deposit a fixed amount of money at regular intervals (e.g., monthly).

2. *Fixed tenure*: The deposits are made for a specified period, which can range from a few months to several years.

3. *Interest earnings*: The deposited amount earns interest, which is compounded quarterly or annually.

4. *Maturity*: At the end of the tenure, you receive the total amount deposited plus the accrued interest.

*Benefits:*

1. *Disciplined savings*: RDs encourage regular savings and help you build a corpus over time.

2. *Fixed returns*: The interest rate is fixed, providing predictable returns.

3. *Low risk*: RDs are generally considered a low-risk investment option.

*Types of Recurring Deposits:*

1. *Fixed Rate RD*: The interest rate remains fixed throughout the tenure.

2. *Variable Rate RD*: The interest rate may change during the tenure.

*Who can benefit from RDs:*

1. *Individuals*: RDs are suitable for individuals who want to save regularly and earn fixed returns.

2. *Salaried professionals*: RDs can help salaried professionals build a corpus for long-term goals.

3. *Small investors*: RDs are a good option for small investors who want to invest regularly.

*Things to consider:*

1. *Interest rates*: Compare interest rates offered by different banks and financial institutions.

2. *Tenure*: Choose a tenure that aligns with your financial goals.

3. *Premature withdrawal*: Understand the terms and conditions for premature withdrawal.

Recurring deposits can be a good option for those who want to save regularly and earn fixed returns. However, it's essential to evaluate your financial goals and risk tolerance before investing in an RD.